The highly concentrated US breakfast cereal market is facing increasing competition as consumers turn to more convenient, healthier options. Cereal sales have sagged; down by 11% in the five years to 2017, according to market researcher Mintel.

Americans are still eating cereals, though – it’s a huge market, after all, accounting for more than a third of the $35bn global market, clocking up $12bn in sales in 2018 – but changing habits mean consumers are not eating it every day.

The territory is also being nipped at the heels by Asia, Europe and Africa, all of which are annually clocking in increasingly higher sales.

“In these nations, instead of breakfast cereals being an entrenched product that competes with new breakfast options, cereals are being introduced as an alternative to traditional fare,” said David sprinkle, research director for Packaged Facts.

“The Westernization of the diet in many of these areas also makes breakfast cereals a novel and enticing food option.”

The market researcher has advised the palling North American industry to follow suit to revive consumption.

“Despite the flagging cereal consumption in North America, there’s reason for optimism as cereal brands and marketers continue to evolve to meet consumer needs and keep their products from feeling stale.”

According to Packaged Facts, producers should keep six trends at top of mind, which will maintain domestic market sales.

Harvest a ‘health halo’

Boost a brand’s perception by using healthier ingredients – such as ancient grains, seeds and nuts – along with pro-health ingredients – such as probiotics and prebiotics.

According to IRI, sales for the four week period ending September 8, 2019 in the US ready-to-eat cereal sector remained flat at 0.3%, tipping in at just over $664k.

The much smaller hot cereal segment fared slightly better at 0.7% growth, clocking it just shy of $94k.

The category benefits from the positive health perceptions of oatmeal, in particular, with its high fiber content and satiety properties. Producers have also capitalized on the customization potential it offers through the addition of fruits and high-protein inclusions.

Top 10 hot cereal/oatmeal brands

Source: IRI data for US muli-outlets w/ c-store (including grocery, drug, mass market, convenience, military and select club and dollar retailers) for the four week period ending September 8, 2019

Get creative with novel flavors

Offer limited-time novelty flavors – which inspire publicity and one-off sales – or nostalgia-inducing flavors, particularly aimed at millennials, who love to recall sugary childhood favorites but in a healthier version.

For those manufacturers opting to focus on indulgence, appealing to nostalgia has been an increasingly common and successful strategy.

A good example is General Mills’ roll-out of an ice cream-flavored cereal inspired by Drumsticks – the well-known ice cream sundae cones – earlier this year.

The company also introduced Fillows cereals, stuffed with Hershey’s Cookies & Cream and Cinnamon Roll filling – the ‘only cereal to deliver a crunchy shell with a burst o crème filling in every bite’.

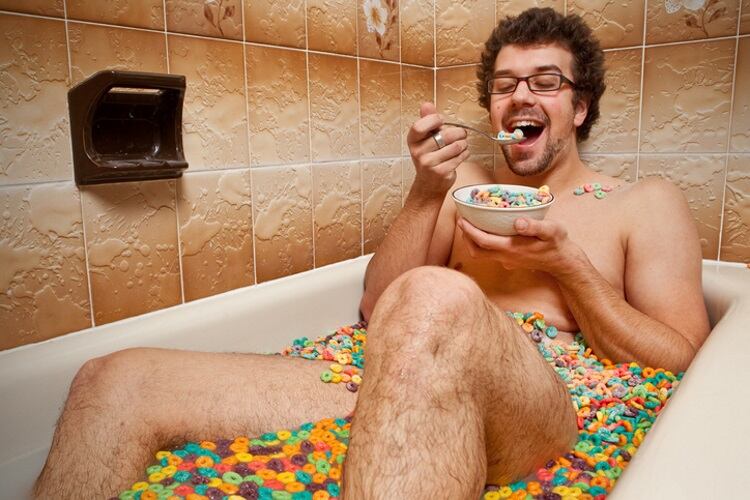

Market beyond breakfast

Reposition cereal as a snack or dessert.

The rise in in the ‘snackification’ trend has been a crucial factor for the growth of breakfast cereals market.

Post Consumer Brands has perfectly capitalized on this with its series of Dream Cereals, which morph breakfast into other eating occasions.

The series includes eight dessert-forward variants, including ‘chocolatey, crunchy’ Oreo O’s, Golden Oreo O, S’mores, peanut-shaped pieces of Nutter Butter, Nilla Wafer’s flavored with banana and marshmallow, America’s Favorite Chocolate Chip Cookie, and the tart sweetness of Sour Patch Kids.

The company claims ‘There nothing quite like it, even in your dreams.’

Capitalize on convenience

Usie single-serving packaging that may include a utensil to facilitate on-the-go consumption, as well as packaging for hot cereal that can be used in its preparation.

Convenience is king – as long as its tabled with taste. In 2017, Mintel’s cereal data revealed that, while only 14% of consumers buy single-serve packages, two in five said they wished cereal was more portable.

In March, Nestlé released special packaging designed for consumers to enjoy their cereal straight from the box, milk and all. The multipack Box Bowls included Shredded Wheat Bite Size, Nesquik, Original and Frosted Shreddies, and Multigrain & Honey Cheerios.

Add value with add-in ingredients

Include fruit, nuts and other add-in ingredients in a separate compartment of the pack.

According to MarketsAndMarkets, food inclusions are gaining demand as they add to the product’s aesthetics and organoleptic & sensory properties.

Inclusions are most widely used in cereal products, including cereals, snacks and bars and is forecast to dominate the sector through to 2023. This is largely attributed to the multiple benefits they add, such as flavor (fruit, chocolate, caramel and nut), texture, enhancement in appearance in terms of color and visibility, and event added health benefits.

Owing to the growing industrial demand – the global food inclusions market is forecast to reach $15.78bn by 2023 – players in the sector are constantly innovating with various types of inclusions in different forms and characteristics that cater to consumer demand.

Pay attention to packaging

Interact with consumers – particularly children – via smart labels and other packaging components, such as graphics and, increasingly, augmented reality, to enhance the breakfast experience.

Smart packaging and connected packaging is firmly positioning itself on the radar, according to Deloitte. The sector is still emerging but cannot be ignored, growing at 11% annually and expected to reach $39.7bn by 2020.

Mike Armstrong, MD of Monitor Deloitte, noted businesses are increasingly looking at packaging as a possible holistic solution to transform the way they deliver, sell and use products.