‘Healthy’ foods and flavors are on the rise, as Americans become more aware of what they are putting in their mouths and relate that back to product labels.

Today’s consumers – and especially millennials – are increasingly seeking out snacks that meet certain requirements or claims, perceived to be ‘better for you,’ along with key attributes like ease of consumption, variety and portability.

The meteoric trajectory of free from

Globally, the free from space is experiencing a meteoric rise in growth, as the public becomes more aware of food allergies and intolerances. The gluten-free market, especially, is rocketing. According to Statistia, by 2020, the market is projected to be valued at $7.59bn.

Superfoods and spices linked to health properties – like turmeric, cumin and ginger – are popping up more in the snacks space. Similarly, plant-based ingredients – like fruit, nuts, seeds and the use of ancient grains – are increasingly seen in new product introductions.

The impressive salty snacks sector

However, most Americans still consider snacking to be a ‘treat’ and continue to search out products that offer indulgence.

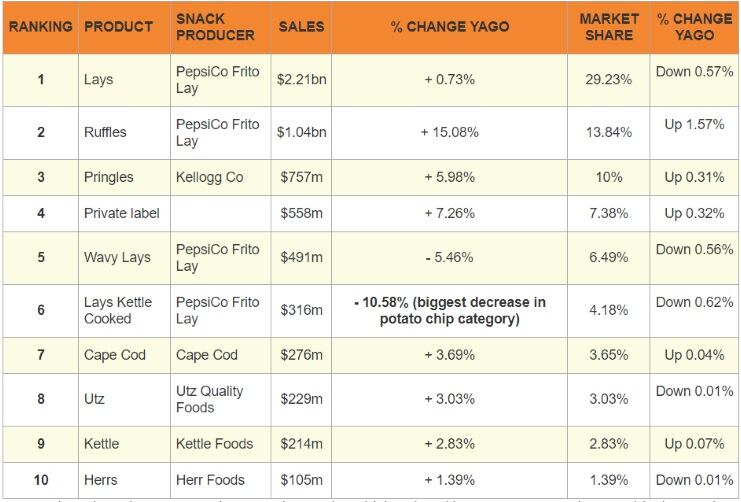

Last year, IRI data (for the 52 week period ending July 15, 2018) showed the Salty Snacks category posted a healthy 4.95% yoy growth, bringing in revenue of $27bn, making it the top selling snack category. Within the category, Potato Chips grabbed the headlines with $7.57bn in revenue following a 2.68% growth.

The Tortilla/Tostada Chips subsector posted the second highest revenue stream, at $5.32bn, followed by Cheese Snacks at $2.31bn (a 6.72% growth yoy), Ready-to-eat Popcorn/Caramel Corn at $1.34bn (4.61% growth) and Pretzels growing 1.19% to bring in revenue of $1.23bn.

In 2017, a survey found that about 86% of American consumers regularly purchase salty snacks, followed by 64% regularly purchasing desserts, so dessert-inspired flavors – like strawberry cheesecake, cookies & cream and s’mores – are some of the most popular options for popcorn and dairy-based snacks.

With the majority of consumers eating snacks to satisfy hunger between meals, savory snacks are feeling the brush of innovation, too, with particularly popular flavors being regionally inspired, like PepsiCo’s rollout of Lay’s Tastes of America featuring Cajun Spice, Chesapeake Crab Bay Spice and Deep Dish Pizza, among others.

Top 10 potato chip brands in US

Source: IRI, a Chicago-based smarket research firm

Nevertheless, there is no stopping the growth of the healthy snack market – globally valued at $21.1bn in 2016 – expected to grow at a 5.1% CAGR between 2018 and 2025, according to Grand View Research.

As the vegetarian/plant-based trend continues on its trajectory, so there has been an increasing demand for the Nuts and Seed snacks. However, these snacks are also widely enjoyed by meat eaters, as they provide the sought-after attributes of protein, fiber and nutrient rich content.

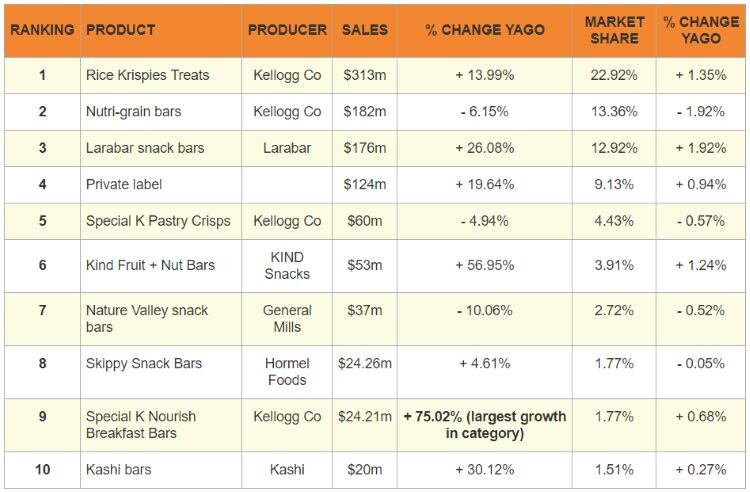

In the US, according to IRI data, the Breakfast Cereal Bar segment raked in the biggest growth in sales among US multi-outlets in the past year. The subcategory is also forecast to gain the largest share in coming years, due to the growing requirement for healthy food along with other benefits such as better taste, filling capacity and portability.

To add to its popularity, athletes and dedicated sportspeople are snacking more on these bars for their ability to provide instant energy on top of the beneficial nutrition content.

Top 10 breakfast cereal bar brands in US

Source: IRI, a Chicago-based smarket research firm

(Retail sales data for 52 week period ending July 15, 2018)