The retailer last month launched the Happy Belly snacking range, which includes nuts and trail mixes, sold in 16 oz two-pack to 44 oz packs and available only to US Amazon Prime members.

The products are priced from around $14 to around $23, with discounts available through the retailer’s Subscribe & Save service.

Amazon has recently been pushing into the private label sector, also launching coffee under the Happy Belly brand and Mama Bear baby food.

Online snack sales

According to data from retail analysts Canadean, less than 3% of savory snack sales in the US market come from internet retailers.

But online is an important channel for the snacks market, added Canadean innovation insights director Tom Vierhile, pointing out that sales of savory snacks through internet retailers are growing at roughly twice the rate of overall US savory snack sales.

“Virtually anything Amazon does is going to be closely watched based on its market heft, but this move could prove to be a significant event in online food retailing,” Vierhile told BakeryandSnacks.

Amazon's Happy Belly snacks brand

Products in the Happy Belly range include:

- Happy Belly Salted Mixed Nuts, 16 oz, 2-pack: $13.38

- Happy Belly Nuts, Chocolate & Dried Fruit Trail Mix, 16 ounce, 2-pack: $14.29

- Happy Belly Salted Mixed Nuts, 44 oz: $15.88

- Happy Belly Roasted & Salted California Almonds, 16 oz, 2-pack: $17.72

(Prices correct on August 15, 2016)

Millennials age group

Currently, just 11% of US consumers say they use online retailers for food and grocery shopping, according to Canadean. But this rises to 20% for consumers between the ages of 25 and 34 – the so-called Millennials age group that is seen as a key target by many snack brands.

Additionally, younger shoppers are generally more receptive to private label than other consumers, found Canadean. More than half (52%) of those in the 25 to 34-year-old age group think private-label brands offer 'much better' or 'slightly better' quality than national brands, versus 29% for all consumers.

“Younger consumers not only have a much better opinion of private-label brands than older consumers, they are also more likely to utilize internet retailers for purchasing grocery products,” said Vierhile.

“These numbers are certainly positive numbers for Amazon, and you can bet these launches will be closely watched by the packaged goods industry as a whole.”

In May this year, the Wall Street Journal reported that, according to 'people familiar with the matter', Amazon would be launching private-label products including nuts, spices, tea, coffee, baby food and vitamins, as well as household items such as diapers and laundry detergents.

Snacks firms tapping e-commerce opportunity

Many snacks businesses are ramping up activity to tap the online retail opportunity.

These include General Mills, which last month said Amazon Fresh and click and pick efforts by major retailers such as Walmart and Kroger were helping to transform e-commerce.

The Nature Valley and Lärabar owner is aiming to tap the trend with a dedicated e-commerce team focused on online content management, precision targeting, web analytics and shopper insight.

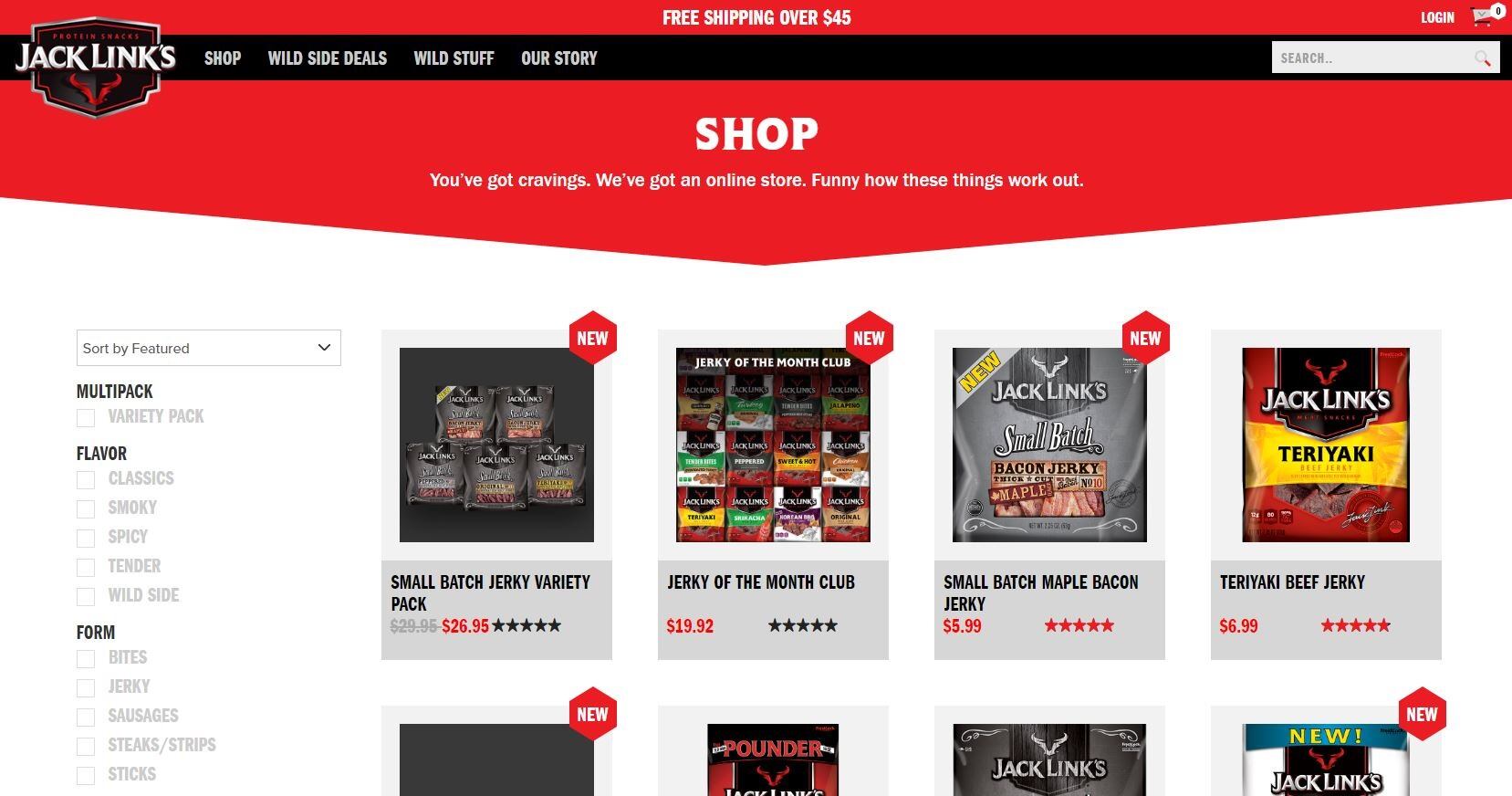

In April, Jack Links unveiled an e-commerce platform enabling it to sell its meat snacks direct to US consumers. Among the line-up are ‘Pounder’ packs that are described as “elusive” by the manufacturer and contain 16 oz of product for $23.99.

Beyond the US, Mondelēz International has partnered with Alibaba to bring Chinese consumers products including Oreo, while Kraft has worked with online retailer JD.com to launch its $1bn Planters nut brand in China.