According to research from One Click Retail, between January-August 2017, the ecommerce giant clocked up a 42% YOY growth in Snacks & Sweets product group.

The numbers

$49bn: Total 2016 US Snacks & Sweets sales

$240m: Amazon.com 2016 Snacks & Sweets sales

$215m: Amazon.com 2017 YTD Snacks & Sweets sales (42% year-on-year growth)

Unsurprisingly, One Click Retails’ report shows the biggest subcategories are Salty Snacks ($31m), Chocolate Candy ($31m) and Non-chocolate Candy ($27m).

However, it also noted US consumers’ preferences shifting towards healthier, non-sugary and organic snacks.

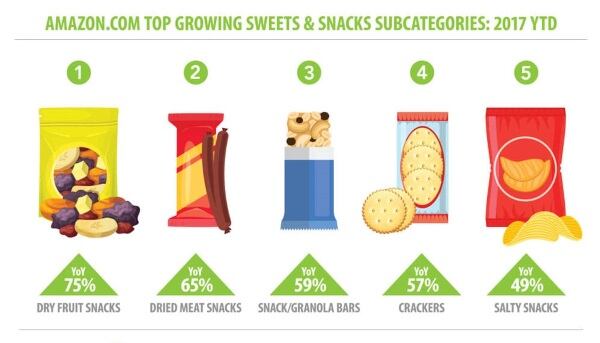

Dry Fruit Snacks experienced the biggest growth (75%), followed by Dried Meat Snacks (65%), Snack/Granola Bars (59%) and Crackers (57%).

Salty Snacks followed with 49%.

Amazon’s success strategy

Competing in the sweets and snacks space offers a number of unique challenges, no less so that it relies heavily on impulse buying.

Amazon’s have tapped into four main programs to drive the burgeoning success in the Sweets & Snacks product group: Private Brands, Prime Surprise Sweets, Alexa and Candy Holidays.

Currently, Amazon has two private snack brands: Happy Belly and Wickedly Prime.

Happy Belly ranks as the fourth best-selling 1P (Amazon vendor central) brand in the snacks category, generating $3.5m YTD.

The brand’s biggest 1P competitor is Planters with $6.5m in snack nuts sales YTD, but according to One Click Retail, Happy Belly’s Trail Mix range has no direct 1P competition on Amazon.

Wickedly Prime ranks 65th in the product group with $800,000 sales YTD. Half of those sales come from popcorn snack bags, which have generated 25% of SkinnyPop’s sales (the leading popcorn contender with sales of $1.6m YTD).

Unlike American consumers’ growing preference for healthier nibbles, snacks and sweet sales in Europe are still dominated by sugary treats, noted the study.

The sweets subcategory dominates in the UK, while chocolate leads in both Germany and France.

Prime Surprise Sweets has brought in about $1.6m in sales YTD and is rapidly growing. The Dash Button generated $65,000 in January, but had grown to five times that size by July.

Surprise purchase

Amazon’s Prime Surprise Sweets program consists of a Dash Button on an Amazon Prime member’s dashboard that is purchased for $4.99. When clicked, the program automatically orders an $18 ‘surprise’ box of assorted speciality chocolates, sweets and baked goods.

One Click Retail’s report shows Artisanal Baked Goods has generated $700,000 YTD, followed by Artisanal Chocolate and Caramels with $300,000 and $130,000, respectively.

The Prime Surprise Sweets package cannot be purchased through Amazon in any other way.

Alexa's call

Amazon’s Alexa has given impulse buying a completely new meaning.

Bypassing the bane of ordering online, consumers simply tell their Amazon Echo what sweet or treat they want, and Alexa places the order in real-time delivered directly to your home, the study said.

Conversely, the online retailer recognized the three biggest chocolate-buying days of the year – Valentine’s Day, Easter and Halloween – are not impulse-driven at all. Amazon has been improving these already high holiday sales – both in volume and in duration.