In this edition of the FNA Deep Dive, we take a closer look into such healthier local options which are rapidly popping up across the region to find out more.

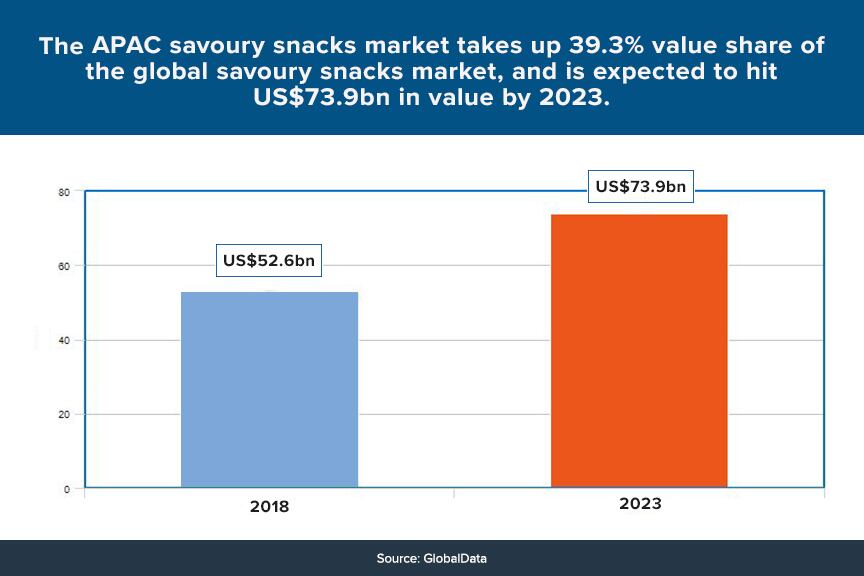

The APAC savoury snack market takes up some 39.3% of the global market in terms of value, coming in at US$52.6bn as of 2018 and expected to grow at 7.1% CAGR to hi US$73.9bn by 2023, according to analytics firm GlobalData.

This growth has been attributed to factors such as rising income levels, and this along with a rising health awareness trend which was present even before - but has also been exacerbated by - the COVID-19 pandemic outbreak has also given rise to consumer demand for healthier, better-for-you snack options.

The general expectation for better-for-you snacks is not so much for these to be extremely healthy, but to be healthier than traditional snacks. Some common attributes include being lower in salt/sodium, saturated fat, sugar and preservatives as well as high in nutrients such as protein or antioxidants.

“No consumer expects healthier snacks to be extremely healthy per se – even if we were to claim that, it is unlikely that they would trust us,” Sreenivas Saba, Co-Founder of Singapore-based poppadum snack firm Uncle Saba’s, told FoodNavigator-Asia.

“Take our poppadoms for example – they are made with lentils and as such very high in protein so this appeals to consumers, but this also makes it difficult for us to process them by baking, and we still have to fry them.

“Consumers are aware that these are still fried, but they still have less saturated fat, no trans fats, less carbohydrates and are made with no MSG, so they know these are still better-for-you than regular chips, and they accept that.”

Poppadoms are thin, crisp flat snacks usually made with lentils, and have been traditionally sold in a raw format for consumers to bring home to deep fry on their own. Uncle Saba’s is a pioneer in making and selling poppadoms as a ready-to-eat snacking format, and is the single biggest name in Singapore and Malaysia within this category.

“It may look simple to make poppadoms into a snacking format, but there are really many nuances to this from the preparation to processing to keeping it crisp with an acceptable shelf life as compared to how consumers are used to eating it, i.e. frying and eating on the same day,” said Saba.

“There are many different lentil chips out there, but the processing is different for all of them, and failure to find the right processing technique will affect the taste and texture severely.

“At the end of the day poppadoms are in line with the healthier snacking trend, which is what people are looking for these days.”

Australia’s Harvest Box, which is also the proud owner of the first 5-star Health Star Rating chip product in the market, concurred with this, adding that the healthy snacking trend has spread across generations.

“Consumers are wanting to snack better - it doesn't matter what their age is,” said harvest Box Co-Founder William Cook.

“[This is why] we have been focussed on developing our Chickpea Crisps to be not only the healthiest on the market with a 5-star Health Star Rating, but also the tastiest and crunchiest. These are designed to appeal to the mainstream consumer, with all the benefits of a snack from the healthy aisle.”

Chickpea Crisp is also made of legumes (yellow peas and chickpeas) with the relevant Cheddar Cheese or Spicy BBQ flavour seasoning, and claims to contain 3.8g of fibre per 28g serving, 3.1g protein, and 86 kcal.

The dangers of meat snacks

Consumers with an eye on higher protein and less carbohydrate consumption also tend to look towards meat snacks as a savoury snack option, but many of these tend to be high in sugar or salt and far less healthy than they appear, according to New Zealand’s Bootleg Jerky Founder Ash Razmi.

“In New Zealand, there have been a lot of companies selling cheap, ultra-processed, mass-produced jerky – which means that beef jerky has in general been having a pretty bad rep along with these, but what we do is different as it is all natural ingredients,” Razmi said.

“Trying to change people’s mentality was one of the biggest challenges as people tended to not even want to try the product when we were offering free samples, mostly because they had it already set in their minds that they wouldn’t like it or it was unhealthy.”

Razmi believes that consumers are also looking for healthier options within the meat snack market, where some of the most common issues include the usage of nitrates, preservatives and flavourings.

“Like with all food groups, I think everyone is becoming more aware of what they are eating, so more and more people are shifting to natural products, [so within the meat snacks market] more and more people are moving towards more premium products that are not filled with fillers and nitrates and preservatives and artificial flavours,” he said.

“Jerky done properly is high in protein, and low in fats, carbs and sugar, and our market testing over the past 10 months has shown that there is demand in New Zealand for a premium, healthier jerky.”

Jerky is not to be mistaken with another meat snack called biltong, which is also a dried meat product but marinated and dried as a big slab before being cut into pieces, whereas jerky is cut into pieces before being processed – meaning that biltong generally has a higher fat content than jerky.

“Biltong is a more established market in New Zealand, it’s basically available at every gas station, and there are some manufacturers who are really pumping out the mass-produced stuff so it’s a pretty big market,” said Razmi

“One of the main issues with mass-produced meat snacks, whether it is jerky or others, is that it tends to be brined in a lot of sugar. The main reason for that is that when you dry the beef, two-thirds of the weight is lost, so essentially 1kg of beef makes just 300g of jerky, but if this is brined in sugar, 1kg of beef could give around 600g of jerky – and sugar is a lot cheaper than beef.

“So if you look at the ingredients list, generally a 50g serving of mass-produced product would have around 12g of sugar, which is really a lot, whereas our sweetest flavour has just 1g of sugar, and that’s just for taste.”

Bootleg Jerky’s products skew towards the healthier, better-for-you direction, as it does not brine in sugar and focuses on using premium ingredients such as local grass-fed beef and all-natural ingredients to replace artificial flavours, preservatives, colours and added nitrates/nitrites.

Watch the video below to find out more.

Big snack firms fight back

Even big snack firms have also been making attempts to keep up with the better-for-you trend. For example, PepsiCo’s Bluebird Foods in New Zealand announced a switch last year to using canola oil to deep fry its chips and lower the saturated fat content in well-known brands such as Doritos, Cheezels and Twisties by at least 75%.

“Consumer needs and preferences are changing, and Kiwis are more concerned about their health and wellness than ever before. [The team has been making several changes to our portfolio, products and packaging to ensure we can meet our consumers’ needs,” said PepsiCo New Zealand General Manager Ali Hamza.

However, this change may not be enough to meet the cut as a healthier snack, as health experts have pointed out that these still remain high in salt and calories.

"The bottom line with chips is even with a lowering of saturated fats chips are still [very] high in kilojoules, high in starch, they're highly refined and very high in salt," nutritionist Bronwen King said in a statement to Stuff.

"[Consumers might think they can eat more chips now], but even though less saturated fat is good for heart health, [chips] are a very high kilojoule product that really is conducive to weight gain, so if people eat a lot of them they gain weight and that's bad for heart health.”

Other big brands such as Kettle Chips and Lay’s have less-salt versions available in the United Kingdom and Europe – but these are rare in the Asia Pacific market.

Nestle is looking to produce a different version of a healthier savoury snack in Vietnam – air-popped popcorn in savoury flavours.

“We at Nestle understand that savoury is always among the top-of-mind flavors for consumers when they think of snacks, and they are always excited to see their favorite savoury dishes’ flavours applied to familiar snacks,” Nestle Vietnam told FoodNavigator-Asia in an email statement.

“Taste still remains the integral factor when it comes to snacking [but there are also] increasing concerns on health, which has become even more critical post-COVID-19. Consumers [are also looking for] high quality products which are safe in terms of ingredients, production method, packaging and those with health benefits – [which we believe our upcoming savoury popcorn line can deliver].”

Localised flavours and ingredients on the way up

Localised flavours and ingredients have also been a key trend within the savoury snacks market, and is a key direction for snack makers to capture consumer taste buds, according to Saba.

“People here crave local flavours – the future of snacking in APAC and especially in Asia is very much going to be less westernized, more local flavours, which is why we spent so much time building our product taste profiles,” he said.

The firm’s flavours include localised ones such as Original, Tomato, Sweet Chilli, Hot & Spicy Mala and Singapore-specific Chilli Crab in conjunction with this year’s National Day, as well as other more common options such as Korean BBQ, Cheese and Sour Cream.

Uncle Saba’s is also looking to expand to more countries in the ASEAN region by next year, especially Thailand, where Saba is looking to experiment with more unique local flavours.

“If you go down to the snacking aisle in Singapore or Malaysia, there’s probably like five or six different flavours for a snack at any one time, but it’s different in Thailand, like for Lay’s where there can be at least 10 different flavour options which are both innovative and interesting,” he said.

Razmi concurred, adding that Bootleg Jerky’s most popular flavour has also been one with local connotations, the Manuka Honey Teriyaki.

“Manuka Honey Teriyaki uses local manuka honey from Great Barrier Island, and I think it’s our biggest seller because people associate manuka honey as a really New Zealand-type of flavour,” he said.

“We’re also looking at bringing in more unique flavours such as kiwifruit habanero – with kiwifruit as a well-recognised New Zealand fruit - as well as collaborating with a local firm that is well-known for their barbecue rub.

“Along these lines, people are generally moving a lot more towards supporting local businesses in New Zealand after COVID-19 too, across basically all the categories - As soon as the lockdown happened, it opened our eyes to how reliant we were on big, mass-producing overseas companies, when we actually have many local companies in New Zealand that can do many of the same things.”

Keeping in touch with local trends has also been seen to be an important factor – Singaporean snack firm Ooh SG launched a snack range dedicated to mala (numb and spicy) snacks in the country due to a rising mala hotpot trend.

“Mala is still a relatively new cuisine in the Singapore market, and the numbing sensation that it brings is still not within our [regular] taste profile, [but] our main consumers are those between 16 and 40 years of age who have been exposed to the mala trend through foodservice such as Haidilao,” said Ooh SG Founder Gervor Quek.

This appears to have paid off too, as Quek has observed a 300% year-on-year increase in sales since he established the firm in 2018.

Challenges for healthier snacks

Although better-for-you snacks look to be the future, common snack formats such as deep-fried potato chips or extruded snacks don’t appear to be going anywhere just yet, and their persistency and familiarity remain a serious challenge for new-generation healthier snacks trying to catch up.

Even Quek highlighted that his best-selling product remained the fried potato chip, and also that his snacks still had to be heavy on salt to bring out the mala flavour.

“We have also launched a healthier cassava chip option which is a more complex carbohydrate, and also just launched a green peas option – but at the moment the potato chips are still the most popular,” he said.

Saba also observed that the familiarity of such snacks for consumers remains a tough hurdle for newer types of snacks to overcome, especially during such trying times when consumers are looking for comfort and recognisability.

“These snacks still rule the market, and consumers will tend to go back to what is most familiar to them, so this is definitely a challenge for newer snacks like ours,” he said.

“The main thing is to remain true to the value proposition despite this and look to the long-term, because when it comes to better-for-you snacks, at the end of the day it’s all about the value that can be brought to the consumer, and health is rising in importance as a trend.”

Razmi also concurred and added that the sheer quantity and availability of less-healthy snack options means that better-for-you options still has a ways to go before making a significant dent in the market.

“I don’t think meat snacks or better-for-you snacks are likely to overtake the more common snacks like fried potato chips or extruded snacks as it’s just too easy to make cheap, unhealthy products,” he said.

“It’s definitely catching up though, and better-for-you type brands are starting to take more of the market share from the big, mass-producing guys, but I don’t think that they will overtake these any time soon.”

On the other hand, Cook added that the recent COVID-19 pandemic has raised consumer awareness of healthy eating – and snacking – to much higher levels than before, and this could mean good news for healthier options.

“That we managed to launch our Chickpea Crisps even during the outbreak shows that demand for [such a better-for-you] product remained strong throughout this period,” he said.

“We feel COVID-19 has allowed [consumers to better realise how to] look after themselves – and one of these ways is to snack and eat better. In realisation of this trend, we have even increased our new product development as we feel the market for healthier snacks is set to grow even faster now.”