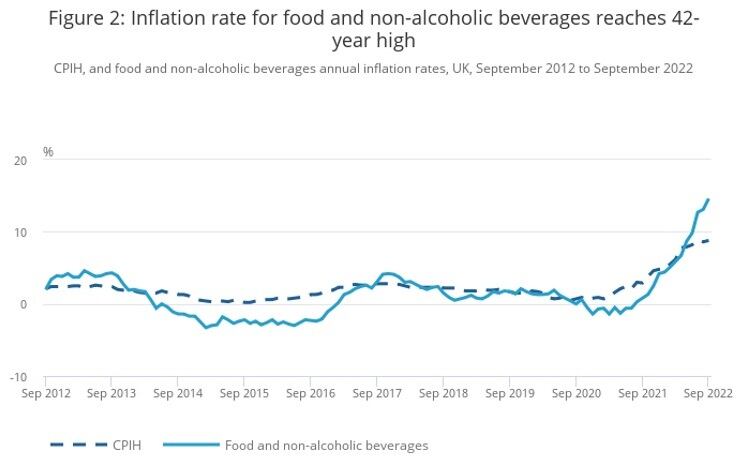

With inflation already on the rise, the UK PR specialist first commissioned a survey in December 2021 to find out consumer sensitivity to increases in food and beverage prices. Now, thanks largely to the Russia-Ukraine conflict, the cost of living has skyrocketed.

“Since we first conducted our price sensitivity survey in December 2021, the war in Ukraine has exacerbated an already volatile situation,” said Richard Clarke, MD of Ingredient Communications.

“As well as difficulties sourcing certain raw materials, fuel costs have gone through the roof. With winter on the way in the western hemisphere, and no sign of Russia backing down, demand for energy will spike and it’s hard to see any short-term easing of the inflationary pressures that food companies and consumers are facing.”

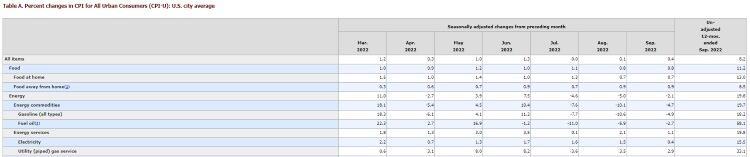

According to the Office for National Statistics, year-on-year inflation in the UK’s food and beverage category was 14.6% in September 2021, while the US Bureau of Labour Statistics noted inflation for food consumed in the home was recorded at 13% for the same period.

December 2021 versus October 2022

Ingredient Commissions’ second survey – conducted by SurveyGoo,000 among 1,000 American and British consumers in the first week of October 2022 – found 57.8% had switched to a cheaper brand, compared with 47.5% in 2021. Of those not prepared to compromise, more than half (50.9%) bought less of a product, up from 40.8% in late 2021.

A quarter of respondents (24.9%) stopped purchasing a preferred product altogether in the previous three months due to a price increase. This is significantly higher than 10 months earlier, which revealed 17.6% of shoppers had traded out of a product because it had become too expensive.

The research also found 48.4% had purchased a product less often, compared with 36.5% previously.

Retailer brands are benefitting from the squeeze, with 35.6% switching to an own label version of a product, versus 25.8% in 2021.

Nearly all respondents to the latest survey (98.1%) had noticed the jump in food prices in the previous three months, compared with 94.2% in the 2021 survey.

Engage with suppliers

“In manufacturing, it’s tempting to look for quick fixes to cut costs but in the food industry there are always risks to this,” added Clarke.

“Consumers are very attuned to recipe changes and pack size reductions and social media means news of these can spread fast.”

He advises that producers should maintain the quality of their goods and rather start a dialogue with their suppliers.

“We’ve always advocated using high quality ingredients that differentiate a product. But in these challenging times, it’s also worth talking to your ingredients suppliers to see how they can help,” said Clarke.

“Many have extensive formulation expertise and might be able to advise on how to reduce input costs without compromising on quality or losing brand equity and consumer trust.”