BakeryandSnacks spoke to Burke Raine, VP and general manager of Conagra’s snacks business, who oversees category-leading brands like Slim Jim (meat snacks), Angie’s (RTE popcorn) and David (seeds).

“We’ve got a portfolio that has a right to play in a lot of occasions and a lot of dayparts,” Raine told us at NACS, held in Atlanta, US, at the beginning of this month.

Shedding non-synergistic brands

The Chicago-based company, which also holds strong market share in frozen food, has doubled down on its snacking business in recent years – in part through acquisitions of disruptive brands like Angie’s, Frontera Foods and Duke’s premium jerky.

It also bought Pinnacle Foods late last year for $10.9bn (including debt). That purchase – which brought the likes of Vlasic, Duncan Hines and Aunt Jemima into the fold – has not been without issue: Conagra stockholders have sued, claiming the company ‘buried’ Pinnacle’s financial struggles. Conagra has acknowledged that some of those brands needed attention.

Most recently, the company offloaded Pinnacle’s direct-to-store (DSD) brands, including Snyder of Berlin, to Utz Quality Foods. That deal closed on October 21.

Raine reaffirmed what Conagra told us about that deal in September.

"There is going to be a limit to our ability to unlock growth on these DSD brands. We found a buyer in Utz Quality Foods who operates a very large DSD system, and there were a lot more opportunities for these brands to thrive over with Utz,” he said.

“Snacking is a core strategic priority for Conagra, but we are a warehouse company… it was a small percentage of our snacks business, and we think that it synergistically will be of much more value to the Utz organization than to Conagra.”

On display at NACS was Conagra’s two-feet-in approach to relevant categories: selling a modern, premium brand next to an established, accessible one.

“The Conagra playbook – and what’s fueling all of our growth right now – is taking iconic brands [and] infusing them with modern attributes that enables [us] to premiumize the experience and make a better margin.” – Burke Raine, VP/GM of snacks at Conagra

Meat snacks

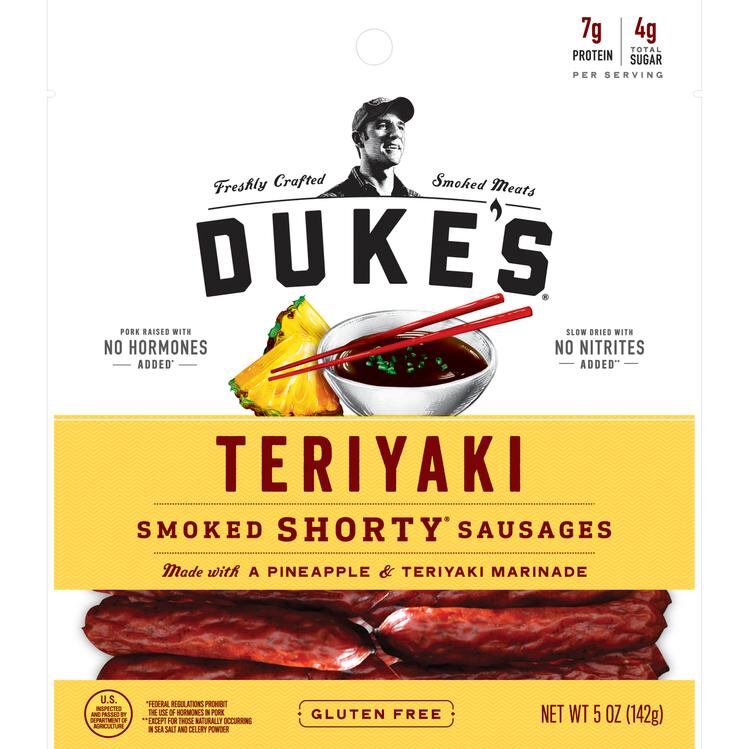

Duke’s, which Conagra bought in 2017, appeals to consumers looking for a better-for-you jerky. Its new flavor – teriyaki, the second most popular flavor in meat snacks, according to Raine – features real pineapple chunks and never-frozen meat smoked with real hardwood and preserved without nitrates.

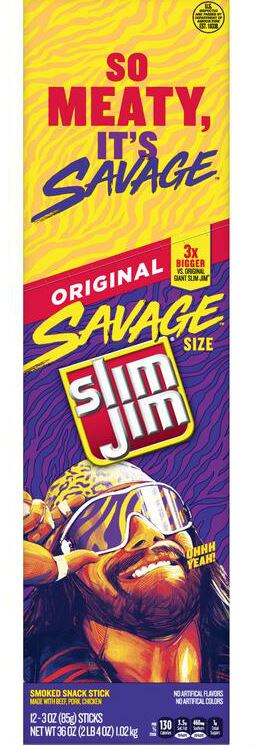

On the other end of the spectrum, Conagra also has Slim Jim, which Raine described as “a mainstream brand at a mainstream, accessible price point.” At NACS, longtime fans would recognize the brand’s 90s-era spokesman, celebrity wrestler Randy Macho Man Savage.

“When people think about the Slim Jim brand, he’s a core, iconic piece of it,” said Raine. “We really wanted to do something special for this new size,” that being the Savage Stick, which is three times longer than a regular Slim Jim. “Calling it Savage was a great homage to Randy and a great way to bring him back and integrate him in the brand.”

Raine said the company views Duke’s and Slim Jim as complementary brands; in convenience, they would sit side-by-side in the meat snack set, but only Duke’s has distribution in Whole Foods.

“It does give us some reach that we couldn’t get with Slim Jim,” he said, adding Duke’s also performs better at Costco.

Put bluntly, Raine said: “Meat snacks [is] one of the fastest growing categories within all of snacking, and snacking is the fastest growing occasion in food. So you’re in an ultra-hot space within a hot space.

"There’s lots of new competitors in meat snacks and a lot of people see the growth. We think Slim Jim occupies a really special place in American culture, and as we’ve done more innovation against Slim Jim – as we put more focus on it – we see it growing quite rapidly versus where we were even a year ago.”

He cited 8% year-over-year growth, a ‘pretty tough’ metric to achieve for such an established brand – one that already commands about half the meat snacks business overall.

Seeds

Conagra also double-dips in the seed category, which market research firm SPINS cited as a top 10 trend for 2019 – especially seeds with globally inspired flavors.

Bigs came along with the 2017 acquisition of Duke’s, both then-owned by Thanusi Foods. That brand has provided a boost in ‘big, bold flavor,’ said Raine.

Its Taco Bell flavor, launched at last year’s NACS show, quickly became Bigs’ second-most popular.

At NACS 2019, Conagra debuted a cheeseburger seed, while other flavors include a dill pickle collaboration with Vlasic and a Zesty Ranch partnership with Hidden Valley.

Then there’s David, a nostalgic brand that tends to appeal to a slightly older consumer, according to Raine. To innovate on what has traditionally been a hardcore sunflower seed brand, Conagra has added Energy-Packed Mixes. Available in three flavors – Sea Salt, Ranch and Bar-B-Q – these ‘nut-free trail mixes’ blend sunflower kernels with crunchy lentils, chickpeas and pepitas.

Not only do they diversify the brand, explained Raine, they also “help us with a bit of a dilemma: there’s only so many people, as a percentage of the populous, who know how to seed. It’s a skill you learn.”

Incorporating the deseeded kernels allows any consumer to enjoy the “nutrition and goodness of seeds without having to know that particular skill,” he said.

Popcorn

Since acquiring Angie’s BOOMCHICKPOP for $250m in 2017, Conagra has transformed the kettle corn brand into more than just that.

This year alone, the brand has essentially entered two new salty snack sub-categories: puffs and trail mix.

At the show, Conagra featured drizzled popcorn in flavors like Strawberry Greek Yogurt and Chocolate-Covered Raspberry.

“They’re a little bit more indulgent; however, they still have that kiss of permissibility people are looking for,” said Raine, touting the brand’s various better-for-you selling points.

“They’re non-GMO, gluten-free, they’re made with real, whole ingredients. We think that’s a fun way for somebody to have a bit of yummy indulgence but still maintain their better-for-you aspirations.”

Conagra has also invested in its Crunch’n Munch brand that had admittedly been neglected. Rather than the traditional box, the popcorn – in flavors like Birthday Cake and Brownie Brittle – is now packaged in resealable pouches, which “really elevated and premiumized the offering,” said Raine, while still maintaining a fairly low price point.

Conagra also owns Act II and Orville Redenbacher's, two leading microwave and kernel popcorn brands.

Wise pack decisions

One way to access consumers at different times, to satisfy different demands, is through simple packaging options.

“We look at packaging as a way to get rid of consumer friction,” said Raine. “If it’s something where we can use the same food but put it in a different package that addresses a new consumer need, in a different daypart or occasion, then it might be another SKU – but it’s also going to be highly incremental volume for us.”

Take Duncan Hines, for example, which introduced its 'cake cups' (called Perfect Size for 1) earlier this year: consumers simply add water and pop it in the microwave. These ‘snacking attributes’ can fuel growth in a classic brand that might have fallen out of favor with consumers.

“When the Duncan Hines brand came out, a cake mix that was already pre-made for you was incredibly convenient to the consumers at the time. Fast forward to 2019 and there’s some elements about it that people don’t find so convenient anymore,” said Raine. “How can we provide kits that are complete solutions?

“Anything we can do that adds fun – that adds convenience – with the needs that modern consumers have of being more and more on the go, more and more time crunched... How can we remove more of those barriers to consumption?”

Since introducing popular cake flavors including carrot cake, red velvet, and German chocolate, Duncan Hines has extended the line to breakfast. Nine flavor varieties range from buttermilk pancake to cinnamon French toast, banana bread to blueberry muffin.