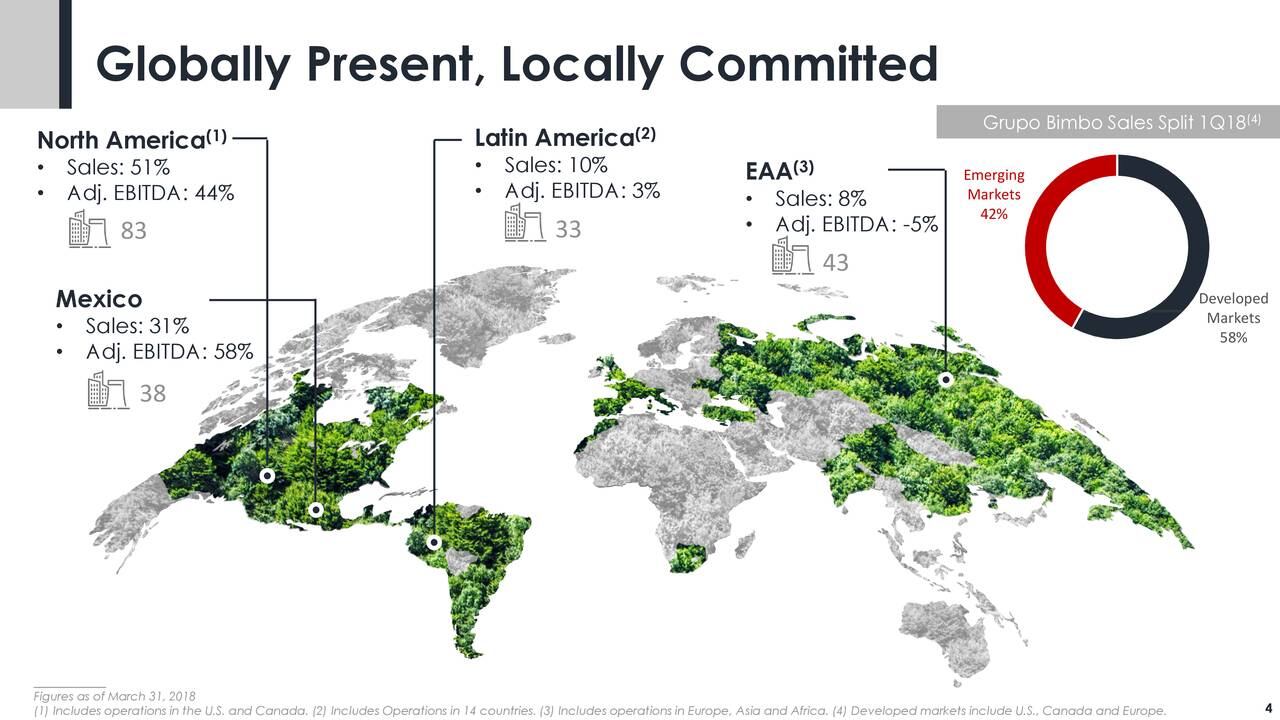

According to Daniel Servitje, Bimbo’s CEO, while the company is concerned about the changes the upcoming elections will have in Mexico, its strength lies in its diversity.

“Our geographic and revenue diversification remains a key strength as we don't rely on one country, but the current situation in Mexico demands a cautious stance,” said Servitje.

“We are tightening our cost structure in order to prepare ourselves for a volatile economic environment in Mexico in which our consumers and customers may be affected as well.”

Global diversity

Bimbo – which in recent years has expanded into China, India and Morocco, while growing its US footprint – posted a first-quarter net profit of 1.27bn pesos ($69.5m), up from 996m pesos in the same period last year.

Sales were 67,154m pesos ($3,594m), up 1.6% from 66,080m pesos.

The company’s operating income in Mexico jumped 19%, and sales there were up 11%.

However, it did report operating income of its North America business fell by 14% to 1.2bn pesos ($60m) from 1.4bn in the first quarter ended March 31.

Bimbo Bakeries USA’s (BBU) net sales were down 6% to 31,983m pesos ($1.7bn) from 34,002m pesos a year earlier.

Sales in dollar terms were up 2%.

“The improvement in dollar terms reflected price increases, good performance in the snacks category, strategic brands in the U.S. and the bread category in Canada, and to a lesser extent, the contribution from the integration of the US operation of Bimbo QSR,” said the company.

Voluntary separation

During a conference call with investment analysts, Fred Penny, president of BBU, explained the company’s voluntary separation program it announced on April 13, which is designed to improve efficiency.

The program – which will be offered to certain salaried associates based on their ages and years of service with BBU or its legacy companies – will provide eligible associates the option to separate from the company with an enhanced severance and health care benefits package.

“We expect to see approximately a 15% reduction in our salaried workforce as we get through the process,” he said. “But we are in the selection window right now, so we don't know exactly how that's going to come out.”

He said he expected the company to take a charge against earnings in the second quarter and to begin seeing cost savings in the third.

Chief financial officer Diego Gaxiola said Bimbo would see higher margins and profitability by the end of 2018 and its consolidated tax rate would fall because of the tax overhaul in the US (falling from 42.9% to 40.3%).

Recent developments

Last year, Bimbo’s acquisitions of the Adghal Group in Morocco, Ready Roti in India, Stone Mill in Canada and East Balt Bakeries and Bays English Muffins in the US expanded its footprint into 10 new countries.

In February, the company announced it had reached an agreement to acquire Chinese breadmaker Mankattan – the second largest wholesale bakery company in China, which produces and supplies sliced bread, cakes, buns and Yudane (a Japanese-style sandwich bread), among other baked products, to modern, traditional and QSR clients. The company operates four plants that serve the thriving urban markets of Beijing, Shanghai, Sichuan and Guangdong, along with their surrounding areas.

The transaction is still subject to the satisfaction of customary closing conditions, including regulatory approvals.

Grupo Bimbo issued $500m in perpetual notes at par to yield 5.95%. The company will use the proceeds from this offering for the refinancing of existing debts and the financing of acquisitions, among other expenses.

The company also signed an agreement with Invenergy in April to supply wind energy for its US operations in its effort to become the first baking company in the US to use 100% renewable energy by 2020.