Milka is considered one of the power brands of Mondelēz. The confectionery firm introduced the chocolate brand last year to the US shortly after it failed to acquire Hershey with a $23bn bid.

In early 2016, Mondelēz also brought Milka to China with a customized recipe and marketed it as a premium chocolate brand in the hope to compete with other international companies who own a bigger market share of the category, including Mars, Nestle, Ferrero, Hershey, and Lindt.

Mondelēz’s spokesman, Steve Mann, told ConfectioneryNews the new Milka brownies are not currently available in the US, and their distribution channels and pricing are something which depends on a market by market basis.

Taking advantage of Milka

Mann added the primary reason why Mondelēz chose brownies as a new product format is because it is “a popular, trendy, growing segment”.

“We feel that the taste of these new soft treats made with iconic Milka chocolate will be something that consumers will love.”

According to Euromonitor Passport’s analysis on Mondelēz released in 2017, 59% of the company’s $22bn global sales of confectionery in 2016 stemmed from chocolate confectionery, compared to 25% from gum and 16% from sugar confectionery.

“More so than Nestlé and Mars, Mondelēz has a solid range of premium confectionery products, particularly within chocolate, with its Green & Blacks range,” Euromonitor said.

“Overall, like Mars, the company has lost out over the last five years as consumers in the chocolate market have shifted towards premium chocolate, particularly favoring Lindt and more niche products.”

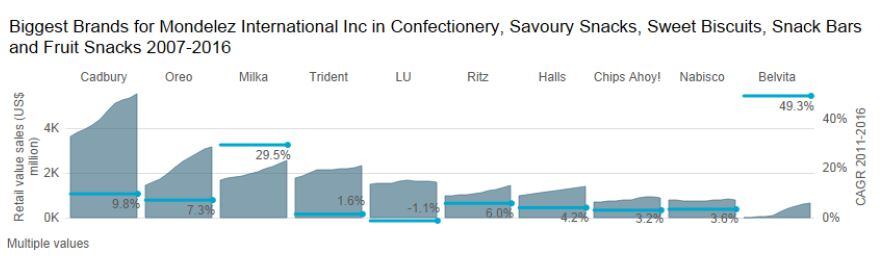

Despite the shift towards premium chocolate, the Milka brand, in particular, has seen “eye-catching growth,” according to Euromonitor, with a compound annual growth rate of over 20% between 2011 to 2016.

“It part, this has been fueled by the brand growing from a low base in the US and China. This trend is expected to continue in the next five years, with Mondelēz deciding to engage in cross-branding of Milka with Oreo in the US.”

Oreo generates $1.6bn in sales, which are comparable to those of the leading chocolate products, Euromonitor said.

Why not Cadbury for the brownies?

During the period of 2007 and 2016, the only chocolate brand under Mondelēz that grew faster than Milka is Cadbury, which posted a CAGR of over 40%, according to Passport analysis.

Mondelēz did not immediately respond why it did not choose Cadbury for its latest brownie products. But it seems like even market researchers felt hesitant to answer whether Cadbury or Milka will lead the future chocolate growth.

“At present, Cadbury’s sales are concentrated in a small number of countries – mainly Commonwealth countries and the UK. It will be interesting to see whether the company pushes Cadbury in more markets worldwide, or instead chooses to focus on Milka,” Euromonitor said.

However, the market research firm pointed out that Mondelēz’s “incessant tampering with the Cadbury brand” in markets where it is iconic, such as the UK, Australia and New Zealand, has left the company with “a spate of negative publicity”.

“These may not affect the brand in the long term, but there often appear to be short-term repercussions for the company as a result of these decisions,” Euromonitor added.

“In the UK, where Cadbury generated $2.5bn in sales in 2016, the company has underperformed against some of its rivals, and part of this may be down to its restless attitude towards its power brands.”

Mondelēz is scheduled to announce its Q4 and full-year results later today (Feb 7, 2017).