For the 16 weeks ending April 23, 2016, the Nature’s Own and Wonder owner reported a 5.1% hike in sales to $1.2bn, with Dave's Killer Bread (DKB) and Alpine Valley Bread contributing 5.3% to the overall sales increase.

Flowers said its earnings in the quarter had been hit by factors including a competitive marketplace, unseasonable weather, and $2.5m costs associated with converting its bakery in Tuscaloosa, Alabama, to organic production.

But president and CEO Allen Shiver insisted the business was taking the right steps for continued long-term success, and that his team was delivering on priorities to execute its plans to drive profitable growth.

Increasing brand awareness

These included a focus on margin expansion, with the business “aggressively improving” promotional effectiveness and increasing brand awareness while taking action to eliminate excess cost and utilise its most efficient bakeries.

Flowers said it had achieved higher prices for its core white loaf and soft variety bread brands, and had launched a new marketing push for its largest brand, Nature's Own, after simplifying the ingredients in some items.

The business also added production and distribution support for organic brands Alpine and DKB, which has been rolling out to more than 9,000 new stores through Flowers’ direct-store-delivery network since April 25.

Flowers Foods: Q1 results snaphot

- Sales: +5.1% to $1.2bn. Acquisitions of Dave's Killer Bread and Alpine Valley Bread contributed 5.3% to overall sales increase.

- EPS: -3.4% to $0.28.

- EBITDA: +1.7% to $138.6m

- Fiscal 2016 guidance: Sales growth of around 5.5% to 8.0% over fiscal 2015 reported sales of $3.8bn

'Growth engine for packaged bread'

“We have invested significant time and money in the roll out,” said Shiver, who described organic as “the growth engine for fresh packaged bread”.

Shiver added that initial feedback from independent distributors has been “really positive”.

“Sales are going well, and distributors are gaining store space and adding special displays,” he told analysts after announcing the results.

DKB contributed 4.5% growth to the company’s direct-store-delivery (DSD) segment.

In the overall segment, although pricing/mix increased 0.2% in the overall segment, volumes declines 1.3%.

Soft volumes offset price hikes

Excluding the DKB acquisition, higher retail prices for branded goods had been more than offset by the softer volume, which the company attributed to factors including decrease in its own promotional activity as competitors ramped up theirs.

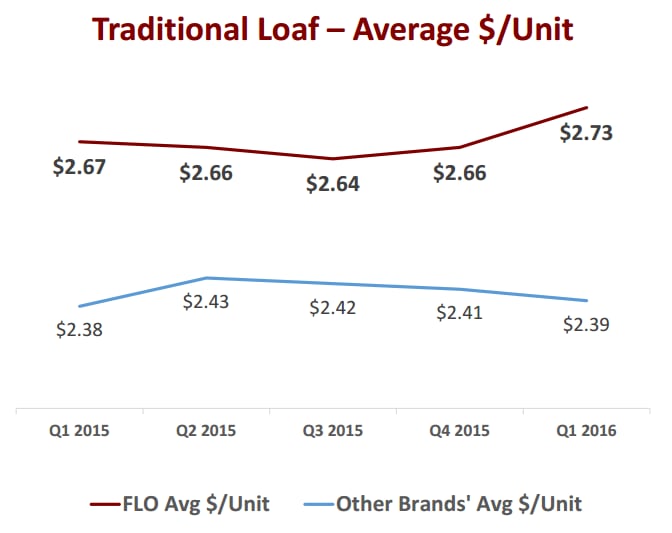

Quarter on quarter, the average price of Flowers’ standard loaves rose from $2.66 to $2.73, while the average price of other branded loaves fell from $2.41 to $2.39, it reported.

Volumes were also impacted by effects of the weather and the impact of the competitive marketplace.

EBITDA margin for the segment fell as a percentage of sales due to higher workforce-related costs, and costs associated with the conversion of the Tuscaloosa bakery to an organic facility. Another factor was increases in outside purchases of product, primarily due to capacity constraints at DKB, reported Flowers.

The increases were partially offset by lower input costs including ingredients, packaging, and utilities, and reduced independent distributor fees as a percentage of sales.

Additional internal capacity

Flowers predicted that, as sales of DKB increase through the DSD network, outside purchases of product will decline as additional internal capacity comes online. It added this would be partly offset by higher input and workforce-related costs.

“With this introduction and less reliance on co-manufacturing, we expect to begin realizing improved profitability on sales of organic breads while capitalizing on strong consumer demand for organic bakery foods,” said Shiver.

In Flowers’ Warehouse segment – which distributes frozen cakes and breads - Alpine products drove a hike in branded retail sales. Segment sales rose 14.2% overall, with Alpine contributing 9.8%. Growth in non-retail sales was driven by volume increases in foodservice following the roll-out of new products.

Lower costs drove an increase in EBITDA margin for the segment, partially offset by increased outside purchases and higher promotional spend on Alpine.