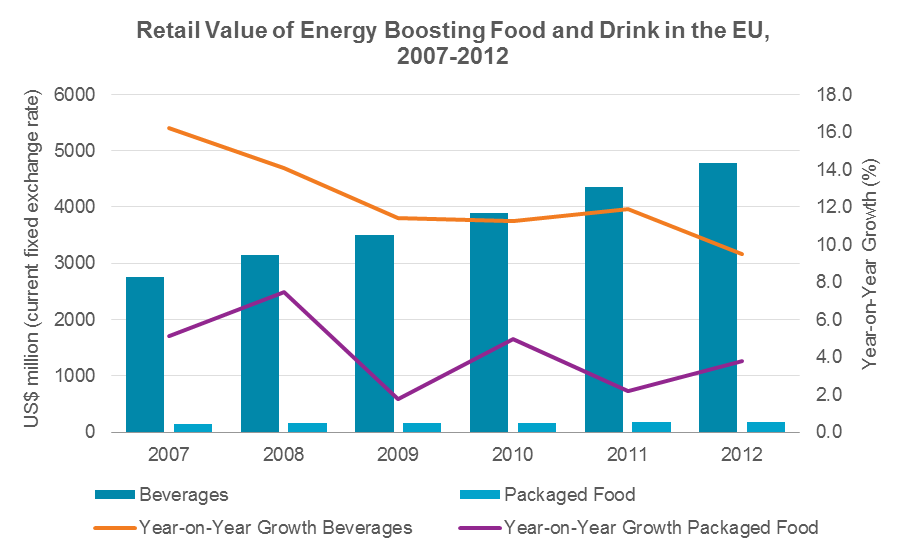

At €22bn, ‘energy’ was the largest and fastest growing functional foods and drinks category in 2011-2012, the bulk in energy drinks. Japan and the US lead the way, with the EU accounting for 17% of total sales, a share down one percentage point since 2007.

The likes of Red Bull and Monster still lead the way, but the EU’s 2012 article 13.1 health claim approvals are offering ‘natural’ energy potential in areas like snack bars and gums.

There are nine EU-approved, energy-related vitamin and mineral-related claims available to manufacturers: Folate, iron, magnesium, niacin (B3), pantothenic acid (B5), riboflavin (B2), vitamin B12, vitamin B6 and vitamin C. All can claim to contribute to, “the reduction of tiredness and fatigue” in the general population.

GlaxoSmithKline in the UK was quick to use vitamin B-energy claims with the launch of its Lucozade Revive in February 2012 (even before the claims entered the official EU register in December that year), offering flavours such as lemongrass with ginger and cranberry with açai.

These vitamins can also be used in combination with other natural energy-boosting ingredients such as guarana extract to offer consumers a proposition to rival that of caffeine.

Caffeine pros and cons

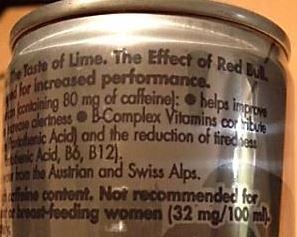

Caffeine remains universally popular thanks to its immediate boost. Red Bull gives consumers ‘wings’ thanks largely to its 80mg dose of caffeine, although approved European Food Safety Authority (EFSA) claims are stalled at European Commission level due to over-consumption concerns expressed by some EU member states.

If the claims are added to the EU register, caffeine will have sanctioned concentration and alertness claims.

Not that Red Bull and other energy drink makers will be too concerned either way when the B vitamins that are part of many formulations can already claim to contribute to normal mental performance and the reduction of tiredness and fatigue. And they are doing this.

Globally Red Bull put on more than €750m in increased sales in 2011-12 so it is hardly suffering over the EU caffeine claims blockade.

But caffeine is causing other concerns. In 2011 the Mexican government banned the sale of energy drinks to minors over health concerns. In New York, the marketing of energy drinks is prohibited if specifically directed at minors.

Kraft’s Wrigley launched Alert Energy Caffeine Gum in the US in April but quickly pulled the product after the Food and Drug Administration (FDA) expressed concerns about caffeine in foods.

In this climate the vitamin and mineral sell becomes more attractive and has the potential to cater for more occasions when the health-conscious individual is in need of an everyday energy boost – and potentially to a wider demographic.

While sports and energy drinks comprised 95% of total EU sales in 2012, a couple of other categories remain interesting.

Snack bars: Vitamin B-rich seeds and nuts

When it comes to energy-boosting foods, worth €2.15bn in 2012, the king is snack bars and EU claims have handed the segment some extra potency.

Magnesium and B vitamins, for example, are found in the likes of bran, seeds, nuts and even molasses and are common ingredients in snack and energy bars. In the EU, energy bars are forecast to grow 36% between 2012-2017, equivalent to about €70m, albeit just an 11% share of global growth.

Energy gum could chew on new claims

Energy gum is still a nascent category and sales have long been flat in the EU at about €12m since 2008. Leading brands are Swiss Army from Victorinox AG in Germany and Antula Healthcare AB’s Vigo gum in Finland, but a push with claim-backed nutrients by big and small players could jolt the category to new levels.

As for the whole ‘natural energy’ sector in the EU, only time will tell how high it can fly with its new health claim wings.