Do consumers prefer sugar or non-nutritive sweeteners? It’s complicated

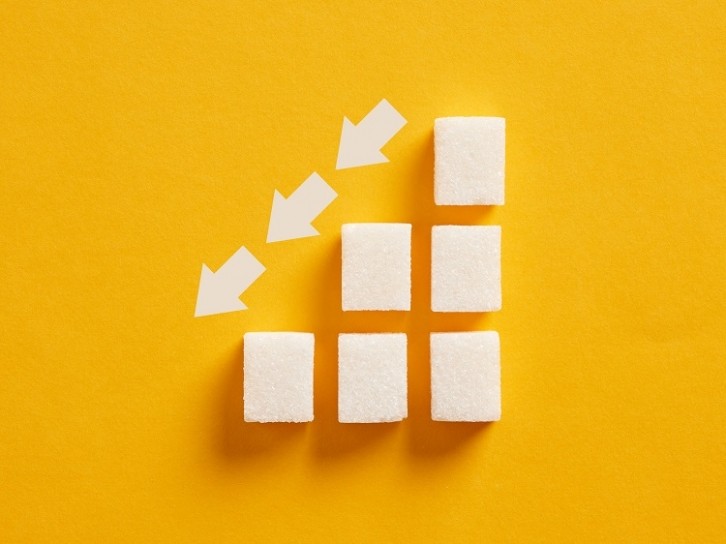

Excessive sugar consumption increases the risk of developing obesity and non-communicable diseases such as dental disease. The nutrient has been on policymakers’ hitlist for years, with sugar tax enforcement increasing globally.

Globally 108 countries tax some sugar-sweetened beverages, and research suggests they’re effective in helping to reduce sugary drink consumption.

But sugar is not the only sweet ingredient being scrutinised. Earlier this year, the World Health Organization (WHO) recommended against the use of non-sugar sweeteners (NNS) to control body weight or reduce the risk of non-communicable diseases (NCDs).

With sugar and sweeteners both in the firing line, are consumers equally cautious about both?

Signs that sweeteners are falling from grace?

To cut down on sugar content, beverage brands have turned to sweeteners. Common examples of non-nutritive sweeteners include aspartame, saccharin, sucralose and stevia.

WHO’s recent recommendation on the use of non-sugar sweeteners came after a systemic review of available evidence suggested the use of such sweeteners does not offer any long-term benefit in reducing body fat in adults or children. The review also suggested there may be potential undesirable effects from long-term use, such as increased risk of type 2 diabetes, cardiovascular diseases, and mortality in adults.

Two months later, the International Agency for Research on Cancer (IARC) classified popular sweetener aspartame ‘possibly carcinogenic’, based on limited evidence for cancer in humans – specifically for hepatocellular carcinoma, a type of liver cancer.

It wasn’t all bad news for aspartame that day: the Joint Expert Committee on Food Additives (JECFA) announced at the same time it found no convincing evidence that aspartame causes harm when consumed within daily intake guidelines.

Others have also raised concerns about NNS. Front-of-pack nutrition labelling scheme Nutri-Score recently amended its algorithm with implications for soft drinks: beverages containing NNS will now score lower. Based on the new algorithm, a soft drink with a sugar level as low as 0.1g, but which contains NNS, will not score higher than Nutri-Score C.

From a consumer perspective, there are also signs that sweeteners are falling out of favour. Recent consumer research conducted by ingredients supplier Kerry found that Gen Z and younger Millennials are placing greater importance on sugar in food and drink, with 36% of these consumers sceptical of ingredients used to replace sugar such products.

Those that did not prefer artificial sweeteners (compared to natural sweeteners) said they were bad for one’s health (55%) and had harmful side effects (41%).

Consumer confusion over sugar vs non-nutritive sweetener

Whether overall sugar or NNS are preferred by consumers likely depends on the consumer, since as suggested by Kerry’s research, not everyone has the same beliefs or understandings of sugar and sweeteners.

Some people living with diabetes may be looking for foods with sweeteners to help manage their blood sugar levels, as too might people managing their calorie intake. But on the other hand, people looking for less processed foods may prefer sugar to sweeteners, according to Brigid McKevith, head of regulatory at food regulatory consultancy Ashbury.

“It’s important to note that there’s still a lack of universal understanding around this topic, causing general confusion and a lack of trust. In fact, some consumers even admitted to not knowing how tightly regulated sweeteners are, and how often they are reviewed by food safety organisations.”

If consumers are feeling confused about how to best reduce sugar in their diet, that’s understandable. According to ingredients supplier Ingredion, guidance to date has been confusing for consumers.

“NGOs and various studies on what to eat and not to eat have left consumers with more questions than answers,” according to Kristen Germana, global strategic director, Sugar Reduction, Ingredion.

But there are at least two data points that are clear: consumers are looking to reduce sugar; and NNS like stevia have ‘overwhelmingly’ been found to be safe. Ingredion markets its stevia as an alternative to sugar and artificial sweeteners.

“Consumers want ingredients that are recognisable, especially for parents when purchasing for their kids. With added sugars being prominently called out on packaging, product formulators are turning to ingredients like stevia, which are both non-GMO and can meet consumer taste expectations.”

‘Sweeteners not an ideal solution’

Other natural sweeteners should also be considered, according to ingredients supplier ofi. When looking to create healthier products, manufacturers should also consider using sweetener alternatives like dates or agave nectar, said Wouter Stomph, category lead for Bakery & Snacks at ofi.

“Traditional sugars and sweeteners work well for different purposes, but both should be used in moderation.”

Others working in the B2B ingredients space reiterate that neither sugar nor NNS are a panacea. “Although added sugar has gained a bad reputation, sweeteners aren’t necessarily an ideal solution,” said Dejan Trifunović, business intelligence manager at Dutch supplier of fruit and vegetable ingredients SVZ.

“This year, WHO advised against the use of these ingredients to control body weight, and Nutri-Score’s latest algorithm update now scores negatively against their use.

“This is seen in consumer perception too: according to Euromonitor, nearly one-third of consumers said they looked for terms such as ‘does not contain artificial sweeteners’ when shopping.”

Do consumers still want ‘zero added sugar’ in sweet drinks?

‘Sugar-free’ and ‘no added sugar’ are common claims on food and beverage products. But if those products are sweet, it’s possible (and in soft drinks very likely) that sweeteners are at play.

This begs the question: do consumers still want absolutely zero sugar in products containing sweeteners, or are they increasingly open to consuming some added sugar?

In ofi’s experience, consumers are still open to sugars in food and beverage products. But what they want to see is ‘natural’ sources and clear labelling, to help them make informed choices.

There are others, however, who specifically look for ‘zero added sugar’, said Ingredion’s Germana. “Whether it is their preference, they have specific dietary restrictions like following keto, or possibly trying to manage their blood glucose because they are diabetic.”

‘Definite’ appeal remains for ‘sugar reduced, ‘less sugar’ or ‘limited sugar’ products, Germana added. “Some consumers are looking for incremental improvements in the foods they eat and might not be ready, or interested, in removing sugar completely.”

SVZ’s business intelligence manager Trifunović agreed that combinations work well for consumers. With many seeking to reject so-called diet culture, the ingredients supplier has observed consumers trying to adopt a more ‘balanced’ approach to their diet.

“As a result, products using a low level of refined sugar, mixed with sweeteners or natural alternatives such as fructose, are also providing popular.”

Some of these sentiments were echoed by Ashbury’s McKevith, who told us that some consumers – whether knowingly or not – are already consuming products with a mix of sugars and sweeteners. And will continue to do so.

“Having a range of different products available to meet different consumer needs is important, and so it’s likely there will always be products with sugar, products with sweeteners, and products that contain a mix of both available,” said the regulatory lead.

That said, McKevith expects ‘natural’ alternatives to lead the way, as they carry less stigma.

“In a recent poll we asked brands what approach they are prioritising to reduce sugar content in their products. The results showed that 70% stated natural sweeteners, 20% reported artificial, and the remaining 10% voted other.”