Growing appetite: The proteins and flavors transforming meat snacks

And this growing diversity has extended to the proteins used in the snacks. While beef continues to dominate the category by no small margin, interest is strong in alternatives ranging from the fairly traditional turkey through to far less common elk and salmon.

“We’re seeing an increase in popularity of pork, chicken, turkey and seafood options,” Jack Link’s vice president of research and development Mike Gerber told BakeryandSnacks.

Category diversity is being driven by increased demand for high-protein snacks, he adds, and particularly for the high protein content of meat and its aid to muscle development and recover.

“You can’t out-protein’ meat snacks,” he says.

Meat snacks worth $2.8bn

The expansion of the market comes as the protein boom fueled overall US category growth of 8.6% year on year in 2015 to $2.8bn in mainstream retail, according to IRI data for 52w/e 27 December 2015. Sales of jerky – which account for just over half the category – grew 5.5% year on year over the period, with even stronger growth seen in other meat snack formats such as sausages and meat sticks, where sales grew 12.3%.

Category sales have benefitted from the success of relative newcomers to the market such as Krave, which grew 62.1% to $34.8m in 2015 [IRI].

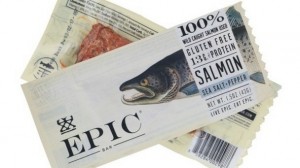

Little wonder, then, that big business has been looking to get a slice of the meat snacks action through acquisitions. Krave was snapped up by The Hershey Company in 2015, and General Mills acquired Texas-based ethical meats snacks manufacturer Epic Provisions in January this year.

Both meat snacks business are tapping demand for traditional beef and pork snacks, as well as offering alternative flavors and meats meats.

Focus on flavors

For Krave, the focus is on flavors - with its Artisanal range including the likes of Chardonnay Thyme Turkey Jerky and Honey Peach Barbecue Pork Jerky.

Epic has set its sights on the demand for less traditional meats, with its range including meat snack bars such as Chicken Sesame BBQ and Bison Bacon Cranberry. Last month it rolled out three new bars inspired by wild game - Venison with Sea Salt and Pepper; Salmon with Sea Salt; Wild Boar with Uncured Bacon - and a new Salmon Maple and Dill flavour of jerky bites.

“Epic has always focused on staying ahead of other meat snacks,” wrote Epic co-founder Taylor Collins in a blog post. “The idea to create an entire line of wild game products was in the spirit of using delicious and healthy meats that are widely accessible, but deep-rooted in the history of North America.”

Scottish salmon

And, far beyond North America, interest in alternative snacking meats is strong, with Meatsnacks Group – which describes itself as the largest producer of jerky and biltong in Europe – launching salmon jerky after acquiring a new factory in the Scottish Highlands.

“The acquisition offers us a great opportunity to continue to diversify our offering and tap into a wider market,” says Meatsnacks Group managing director James Newitt.

And other manufacturers say the use of poultry and seafood is helping to bring new consumers into the meat snacks market. It can also help mitigate concerns around the health profile of meat snacks, and particularly around red meat.

“We know consumers are becoming increasingly more aware about what they put in their body,” says Gerber at Jack Link’s, which offers turkey and chicken jerky, sticks and steak bars. “The range of concerns vary, but certainly there are consumers that are concerned about red meat. Chicken and turkey are perceived as healthier options than beef and that’s drawing consumers to try the category for the first time.”

Meatsnacks Group’s Newitt says the business has not had consumers raise concerns about red meat with it directly but adds: “We are obviously aware it is an issue for some consumers around red meat generally, and certainly the media have ensured this is the case.”

New flavors and formats

Both Meatsnacks and Jack Link’s are also looking to woo new consumers with recently launched flavors and formats.

For Meatsnacks, this is in the shape of Wild West Deli. Rolling out from last month, it is a premium sub-range of its Wild West brand in two flavors -Thai Spice and Chilli & Lime.

“With this new venture we wanted to prove we are capable of producing more than just on-the-go snacks,” says Newitt. “We hope the new premium look and feel of the range, coupled with the quality of the two flavours, will entice gourmet foodies.”

Jack Link’s, meanwhile, is hoping to entice female consumers to the traditionally male-focused meats snacks category with the Lorissa’s Kitchen range launched in April.

Softer and smaller pieces

Described as offering a softer bite and smaller pieces, Lorissa’s Kitchen is gluten-free and available in four flavors: Korean barbeque beef jerky, ginger teriyaki chicken jerky, sweet chili pork jerky, and Szechuan peppercorn beef jerky.

“With brands like Lorissa’s Kitchen, we’re delivering a farm-to-table philosophy that’s speaking to and resonating with a female audience,” says Gerber. “That’s something no one else in the category is currently delivering.”

As for the future, Jack Link’s is experimenting with alternative protein sources, such as buffalo and plant protein sources.

“As the meat snack category continues to grow and attract new consumers, so will the demand for alternative protein sources," says Gerber.